Second Life Economic Statistics Analyzed

by Pixeleen Mistral on 26/04/07 at 8:30 am

by Curious Rousselot, metaverse numerologist

As many of us are no doubt aware; Linden Lab publishes statistics about Second Life. Conveniently they also make the historical data available in Excell and OpenOffice, and Google Docs format. This gives us here at the Herald a chance to see how the economy of Second Life is doing and to comment on it. More importantly, it gives us the chance to make pretty graphs of the information too. So, I thought it might be nice to put some of my amazing spreadsheet skills to use and see what we could get.

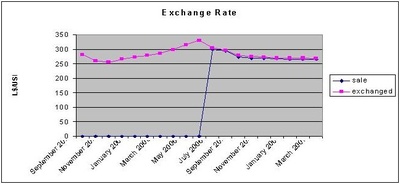

Obtained by dividing the total L$ by the total US$ of LindeX transactions

As we can see, after a serious drop in value of the L$ in September of 2006 the L$ has been holding pretty steady between L$260 to L$270 per US$. Admittedly I’m no economist but considering the relative size of the economy this is pretty impressive stability over the last several months.

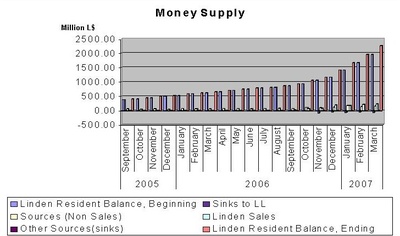

We can see a slow and steady increase in L$ balances held by residents with almost flat supplies and sinks of L$. What is far more interesting is the significant spike in User-to-User transactions. It looks like we really enjoy our shopping in SL.

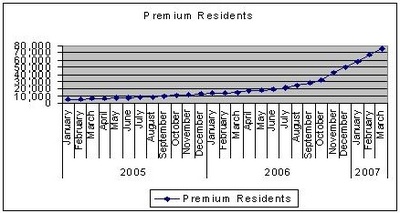

It looks like the number of premium accounts is rising quickly. Linden Lab seams to have made the right decision when they got rid of New Land. This surprised me somewhat since I had been thinking of signing up for a premium account and picking up some new land right around the time that they canceled the program. So, I still don’t have one because I don’t see the point.

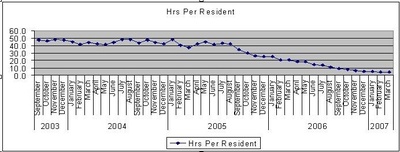

Obtained by dividing the “total hours online by the number of residents”

This last graph will probably help all those who think the boast of having over 5 million residents is a bit misleading. It appears that between 2003 and 2005 the early adopters of Second Life were spending an average of 45.2 hours a month in the game. 2005 itself saw a small drop with an average of 38.1 hours per month.

2006 and so far in 2007 the average is a significant drop with 14.3 and a pathetic 4.9 so far in 2007. As has been said this is probably largely due to the significant increase in one-time-use account. If we assume that the usage patterns of regular users hasn’t dropped significantly we can start to make some real analysis. First we will notice (just from the numbers) that the first significant change in usage appears to start in September 2005 when hours per-user drops significantly from 40.2 to 34.7. Taking the average from before that point (44.3 hours/month) and applying it to the March 2007 number of 3,177,434 total hours spent in SL, we come up with approximately 346,044 active residents with an estimated error of around 5%. This assumes that the active residents are still spending an average of 44.3 hours per month in Second Life.

This may be a far cry from the millions of us advertised but it is a significant increase over the 28,801 figure from July 2005 (prior to the availability of free accounts).

OneBigRiver Stork

Apr 26th, 2007

Disclosure: I am not an economist, but I did room with one in college. I would love to get an opinion from someone whose understanding of economics goes a bit beyond ECON 101/102.

The “amazing” stability of the Linden is no accident, I think. In fact, in the past few months the highest price (in Lindens per US$) has been exactly pegged at 277, from what I can tell. The lowest price has been solidly between 164-167.

I would guess that this has everything to do with Supply Linden. I would guess that they picked a price that they want to stick the Linden at, and place millions of L$ for sale at that price, which is about 3-5% worse than the market price. This stops the market fluctuating, and makes the Lindens a very healthy profit to boot. Did you try graphing the amount of money that is entering the economy via Suppy Linden?

Now, personally, I don’t have a problem with this. Because the user-base is growing, the money supply needs to grow in order to keep up with it, and prevent shortages of the currency. Since it does not really make sense for the Lindens to get into the lending business (which is another typical way of adding money to an economy, I think), I don’t see what else they could do.

But the point is that the price of the L$ is not a being artificially held low. I think the danger is what happens when the user-base stops growing. Will the Lindens be willing to give up their new revenue stream? And what if demand for currency decreases, and we start to get inflation? Will Supply Linden be buying back the billions of L$ that he put into the market?

Personally, I keep all my liquid assets in US$.

OneBigRiver Stork

Apr 26th, 2007

To clarify my previous post: I think all Supply Linden sales are via limit sales, and market sales. This allows them to set the price for “new” L$ to be 3-5% more expensive than “used” L$ bought from another player. This means that there *is* some cost to introduce new L$ into the market. As long as there is a supply of “used” L$, people won’t buy “new” ones minted by Supply Linden.

Perhaps, however, I have horrendously naive about economics.

Trinity Dejavu

Apr 26th, 2007

I think you’ve hit the nail on the head – Supply Linden caps the market and prevents the run away inflation we saw back when the day traders were king.

Prokofy Neva

Apr 26th, 2007

I’ve made this point over and over again: Supply Linden prints money, and that is what “stabilizes” the currency. This month, he’s printed probably half of what he did last month due to the huge influx of cash coming on the market due to the casino cash-outs. We’ll have to see how bad the damage is by the month’s end, but LL stands to lose a huge chunk of revenue they were getting from printing currency.

I don’t buy this idea that you need to print A MILLION US DOLLARS (which is what he printed 2 months ago) to stabilize THIS currency. It’s ridiculous. If the value isn’t diluted, if our wages aren’t artificially depressed, essentially, in this fashion, then we would cash out more often, with more, instead of sinking it into other things like Ginko or land on the auction denominated in Lindens (which is supposed to be a sink).

No, there’s no reason to keep the value this low, except that if wages do go too high, then it removes the magical quality of the world for a lot of people, who need cheap prices. New people especially need to feel like they have fistfulls of thousands of dollars in their hands to buy fancy stuff for a song.

Curious Rousselot

Apr 26th, 2007

OnBigRiver,

I did not graph or do any analysis on the relative volume of new L$ vs used L$ on the market but it sounds interesting enough that I will in the future.

I also agree with your assessment that Supply Linden is keeping the exchange rate by controlling the maximum trading value. Looking at the Exchange Rate graph you can see the stabilization started right around the time that LL began selling L$ (July 2006).

Inigo Chamerberlin

Apr 26th, 2007

Can’t see Supply Linden ever buying back L$. Why? Lots of reasons.

Firstly it would blow a great big hole in the ‘L$ are worthless’ part of the TOS. Selling the things is one thing – that makes it clear that some of US think L$ have value. But if LL buys L$, well, think it through.

Secondly, selling freshly printed L$ for US$ is one thing, but to BUY them back, LL would have to use real US$ – where from? And no matter how dumb you think they are, I can’t see them printing US$ (you never can tell though).

Thirdly, to buy L$ back would mean they’d have to stop selling them. Yeah, obvious, but… If they stop selling them it turns of a VERY significant revenue stream for LL. Personally I can’t ever see them doing that. Indeed, this month’s reduction in Supply Linden’s sales must have made their eyes water.

Obscure Doodad

Apr 26th, 2007

FYI to all, a bill has been introduced in Congress to undo last year’s ban in the US of online gambling. Odds look to be about 50/50 this will happen.

Second, the US money supply is controlled by the Federal Reserve Board. LL buying, creating or selling $Ls has no impact on the US money supply. The conversion to USDs takes place only as a priced commodity. There is no risk of LL “creating” real money and no risk to them of being accused of breaking any sort of counterfeiting laws in that regard. LL churning out $Ls is not printing money. It is creating numbers in an account that residents and LL choose to believe have a USD ratio.

Nacon

Apr 26th, 2007

Who made those crappy colored chart for the Money Supply?

Jacko

Apr 26th, 2007

A couple of more words on economy. Sure, the L$ holds against the US$ by the L$ providing liquidity into the market via Supply Linden. But Second Life is now a global experience with more and more international people coming into it.

Against other currencies is obvious the L$ has depreciated as it has followed the US$ trend. Now, if this is what LL is doing, they are playing a very dangerous game which is called “currency peg” or “conversion board” monetary system. Similar to China or to Argentina to name a few recent systems similars to these.

These systems are easy to mantain while hard currency money (i.e. US$) flow in. But if the flows stop, and you have a reverse of the flows, the only way Linden Labs will find to support the L$ is by throwing US$ into the market in exchange of unwanted L$. If this happens you will have a run on the L$ and obviously a devaluation (against all currencies including the $L) and inflation inside the world.

Gaius Goodliffe

Apr 26th, 2007

“As we can see, after a serious drop in value of the L$ in September of 2006 the L$ has been holding pretty steady between L$260 to L$270 per US$.”

Surely you mean “increase in value of the L$”? It used to be it took L$320 to buy US$1. Now it only takes L$270 to buy a US$1. That means the value of the L$ has increased, or the value of the US$ has fallen, since it’s only worth L$270 rather than L$320 it used to be able to fetch. Actually, US$ has been weak recently, so it’s probably a bit of both. But regardless of how you slice it, the value of the L$ increased significantly relative to the US$ in September.

Curious Rousselot

Apr 27th, 2007

Gaius,

You are right. Every time I look at that graph I get it backwards.

Brent Recreant

Apr 29th, 2007

What are you talking about? It’s 1 Dollar per 189L.

Ombrone - Albert Falck

Apr 29th, 2007

Interesting anlysis of the data.

I do not find strange LL is trying to mantain stable the change:

A too strong Linden$ would be very nice for users already doing money inwolrd, but it would actually would be a problem for newcomer making for them less convenient entering in SL.

Of course minting Linden and taking real US$ for Linden is a very good business for itself!

The real problem is pointed by Jacko, till SL is fast growing stabilizing the LL means gaining real $… but if the trend will change LL would be in the need to buy L$. Will they do it? Or will they leave the Linden going down… with a clear nasty effect on the inworld economy?

That’s the real question on the future!

Dave Kobolowski

Apr 30th, 2007

Okay to the people that think Linden stabilize the currency let me get this straight, you are basing this on a chart which shows the currency fluctuating by 20%!?!

Anyway what if they did? They don’t have the kind of tools at their disposal like a Central Bank does, i.e. Interest Rates so I suppose they’d be well with in their rights to do so.