Op/Ed: How Supply Linden Games The L$ Currency Exchange

by Alphaville Herald on 21/06/10 at 4:40 am

by IntLibber Brautigan

Under a normal market, where there is a healthy flow of cash in and out of a given economy, those operating currency exchanges make significant profits in ways most people do not realize. With the LindeX, for example, the spread, i.e. the distance between the lowest sell price vs the highest buy price, rarely exceeded the exchange fee that LL charges users to use the LindeX. Many LindeX day traders would set up framing orders a mere 1 linden above and below the zero profit spread point, in hopes of catching some market activity to profit from. For instance, if you sell L$, you pay a 3.5% fee to LL, which comes out to 9.275L$ if you are selling 265L$ at 265L$/USD. If you buy L$, the fee is US$0.30 per transaction, which is pretty minimal unless you are buying paltry amounts. Still, it narrows the daytraders profit so that a 10L$ spread in prices means zero profit for the normal day trader.

Sudden volatility in the L$ currency exchange

Supply Linden, however, doesn’t pay a fee. He can trade at less than the spread and still make a profit, and more profit than most people perceive, because when Supply Linden buys up L$ that people are selling, the sellers are still paying a 3.5% fee and at the same time Supply Linden can be selling L$ on the other side of the spread for zero net change in the L$ money supply, but Supply Linden just earned 7+%. This is why Supply Linden would always stabilize the LindeX with large framing orders, of 10-20 million L$ on each side of the spread, making sure that, in order for other people to sell by limit orders, they would trade in a narrower spread so they could not profit from trading both ways. It doubled Linden Lab’s profits on the LindeX by doing so and boosted public confidence in the L$ economy by having exchange rates so stable.

LindeX would only have an excursion from this pattern on the weekend when whoever was running Supply Linden was out of the office and his outstanding limit orders ran out.

This was how things used to be run, when SL was a growing, happy, productive, expanding economy where people were putting more money into SL than was taken out.

This started turning around with the gambling ban in August 2007, when the size of the SL GDP dropped by almost half. Casino owners exited with their life savings, and gamblers who still had cash took their money out and went to the other internet casino sites. Along with subsequent bans of other legitimate economic activity (banking, advertising, as well as the homstead tier hike) more and more residents lost confidence in the SL economy and those managing it. They started taking their money out of SL in greater numbers than people were putting money into it.

When this shifted the flows of capital, then the LindeX became a liability to Linden Lab. While they were still making a 7% profit on trading activity, this profit was being drained by having to buy back more L$ than they were selling as capital fled the grid. At first this was a mere trickle. More users stopped bringing money into SL and only lived off of what they earned inworld, paying their US bills to LL with these earnings. As these numbers grew, they synergized on each other, accellerating the liability drain upon Linden Lab’s earnings. Their 7% profit shrunk so that some days they didn’t earn anything on the LindeX, in fact, it cost them more money than they profited.

At this point, it started to become economically advantageous for Linden Lab to cease this prior trading behavior, and let the L$ float freely on the open market, without the deep pockets of Supply Linden to keep it stable. Apparently the decision to make this change happened this past week.

Whether it was because LL didn’t have the money (the recent firing of over 100 employees speaks to their need to cut costs), or was merely trying to maximize profits prior to being sold off or doing an IPO, or perhaps Mark Kingdon forgot to assign someone to manage Supply Linden after whoever was managing that account was laid off a week prior. We will never know the truth, I suppose. Some have proposed that some disgruntled former Lindens are liquidating their L$ savings from their off-duty businesses. If so, they have had substantial savings of over a half a million USD to liquidate.

I believe that Mark Kingdon has realized that with the shrinking economy of SL, it maximizes profits for LL to no longer regulate the exchange rate of the L$. The recent exchange panic has put such a large quantity of sell limit orders on the market that it would cost LL over 6% of its monthly revenues to stabilize the exchange rate again at its former level. In addition to these 6% savings, he doesn’t have to employ someone to babysit Supply Linden’s trading activities, which should save the company at least another $150,000 a year in salary eliminated.

Boosting your profit margin by 6% is something most CEO’s aspire to. It is the thing that pays big bonuses and stock options at the end of the quarter. If the company is for sale, it helps ensure the company is sold for top dollar. Frans Charming commented over on New World Notes that IBM is considering buying Linden Lab. If this comes through, this may explain a lot of things that have happened lately. IBM certainly has plenty of its own staff who can handle all the things that those laid off used to do, so eliminating this redundancy is understandable. We’ll see what happens over the next weeks and months.

Luci

Jun 21st, 2010

The activity of the last days on the SL exchange market proof your wrong. More Lindens are bought and the value of the L$ is slowly (faster than I thought) rising to its former level. If the Lindens aren´t interfearing any more then that most mean that the economy of SL is strong enough to keep the market stable. Maybe it´s time for the Herald to stop publishing rumours and give people some (prooved) facts to read.

Blah

Jun 21st, 2010

You take your little world so seriously.

Pierce Kronos

Jun 21st, 2010

“Along with subsequent bans of other legitimate economic activity (banking, advertising, ….”

Now that’s funny. Were it legitimate, it wouldn’t have been banned.

Oh for the days of under-financed pyramid-scheme banks and the lovely visual blight of ad farms.

Dave Bell

Jun 21st, 2010

I don’t think I’d want to trust the author.

I keep hearing tales of speculators, day traders, and their like, but the Linden Dollar has a remarkably stable value. How can they make a profit?

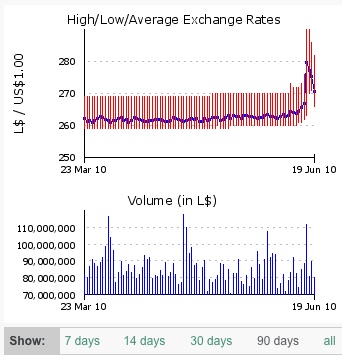

The charts do show a glitch after the announcement of job losses, but this thing took a week to happen, and then hit hard.

I think this thing was organised, and that took time.

It's Unfixable

Jun 21st, 2010

I think I stopped reading at the place where it says “by IntLibber Brautigan”.

Emperor Norton hears a who?

Jun 21st, 2010

You know who else manipulated the economy like Mark Kingdon is doing with Supply Linden? Adolph Hitler, that who! Supply Linden is just the new Albert Speer.

hobo kelly

Jun 21st, 2010

Wellsum, Im a goin’ to that thar SL7B directly, to lookem at alls the stuffs, but I woulda dun had more of them thar Lindens iffn that thar X Street hadn’t shut down their Linden exchange last week. It still aint open fer business fer sum reason…

BamBam

Jun 21st, 2010

This thing smells like a inside job or job that was laid off. OH ya, don’t forget the sky is falling!!! ROFL

The word I am getting is… IBM does not discuss future acquisitions. “I can neither confirm or deign. How did you hear about this?”

Hmmm… That was a dead end.

Wildefire Walcott

Jun 21st, 2010

Hmm… since when does Supply Linden BUY L$? I think some of the recent volatility is due to the fact that Supply Linden/Linden Lab DOESN’T buy L$; they can only apply market pressure in one direction, by selling L$ to keep prices down. Not enough people have been purchasing L$ which is why the L$-to-USD ratio went out of whack last week.

Parker Daxter

Jun 21st, 2010

IntLibber,

Nice to see someone who understands finance…

Guess what people, this is how the real world works too…

The recent bailouts of the banks and financial institutions means:

“All your RL Dollars are belong to us!”

IntLibber Brautigan

Jun 21st, 2010

Luci,

SLExchange trading volumes are a tiny percent of the volumes on LindeX. What happens there is rather meaningless.

Wildfire,

Supply Linden has ALWAYS bought L$ back, in order to keep prices stable as I described. If Supply Linden did not play this role, then LindeX market prices would have shown a much higher volatility over the long term, and certainly would have also had long term upward and downward trends reflecting the state of the real world economy. That there has been no long term impact by the real world economy on exchange rates is proof to anyone with any economic training that LindeX is an artificially stabilized exchange.

give me a break

Jun 21st, 2010

oh give me a break, supply linden used to be selling L$ when the demand for L$ was high. It was found money, and it bloated the money supply, which is PART of why we’re having issues now. (it’s not the only reason)

Now Supply Linden is not selling because the demand dried up. Not only that, the lack of demand for L$ is why there’s no more downward pressure on the LindeX anymore.

as far as LL profiting, oh yes they will profit from a weaker exchange in the short term, because stupid idiot wannabe Donald Trumps (oh, like Intlibber was) are caught out on a fluctuating LindeX, and if those folks on the knifeedge fold – LL gets some nice new sims to sell for cash over in Nascera.

But it could quickly get out of control for LL, if the content creators in SL who are responsible for making the content that spur new L$ sales, cannot cash out. And those nice spanking new Linden Homes actually are eroding the small land sales and rentals, plus also adding more L$ to the economy so there is less need to buy more L$ for these new Premiums. Adds up.

Intlibber is out in fafaland, as usual.

Siggy

Jun 21st, 2010

LOL

Anyone who takes biz advice from Int, will have their business go the way of Int’s

And that aint a pretty sight.

BTW – supply linden doesn’t buy L$.

Rinaldo Debevec

Jun 21st, 2010

I do not agree with many of the things IntLibber has said, however I do think he is correct when he says that Supply Linden buys L$ …

To quote IntLibber :

“If Supply Linden did not play this role [buying L$], then LindeX market prices would have shown a much higher volatility over the long term,”

There is no way I can imagine that such a small market like the Lindex could be so stable, unless Linden Labs has been actively managing the exchange rate by buying and selling L$.

This is BENEFICIAL to all involved parties, both Linden Labs and its customers.

Qie

Jun 21st, 2010

Supply doesn’t buy L$s. The L$ supply has always been tuned to need a relatively steady flow of new L$s — which Supply is eager to sell at the target price. Until recently, the engineered L$ sinks have quite consistently exceeded sources, and sales by Supply have made up the difference–sometimes by nearly a quarter billion L$ a month.

Hence the extreme “stability” of historical L$ prices: Supply ensured that the L$ never gained value above the target, and sinks (plus expanded demand from growth) reliably pushed the value up near the target, exactly as they were designed to do.

For the past few months, the combined effect of sinks and economic growth have not outpaced sources by enough to trigger sales at Supply’s target L$ price. This is in fact considerably more ominous than the spectre of Supply Linden asleep at a mythical “buy” switch.

Rinaldo Debevec

Jun 22nd, 2010

Whatever you say Qie .. sure … BUT I will state categorically that Linden Labs has been buying up L$ the last few days, that is certain!

And in the past, of course, the L$ has always been so desirable that LL has never needed to do anything but sell in order to ensure that the currency doesn’t (heaven forfend!) beccome over-valued!

Yeah… I belive that

Cristalle

Jun 22nd, 2010

Are you a Linden who works on the LindeX? Or a Linden insider who is buying based on inside info? Because there is no proof whatsoever in the economic numbers that LL has ever bought lindens from residents, even in the last few days. There are speculators out there who are trying to take advantage of the chaos.

You should have stopped reading the moment he said that Linden Lab bought lindens from residents.

Frans Charming

Jun 22nd, 2010

What do you base your certainty on Rinaldo?

I tried to post some links back to the days the rules of the Lindex where shaped, for historic relevance. But the comment system didn’t like all my links to much.

This quote is most important:

Lawrence Linden says:

“There are legal reasons why we can’t offer to buy L$.”

You can read my comment here:

http://www.sluniverse.com/php/vb/virtual-business/45533-lindex-rate-monitoring-8.html#post959890

That thread is useful if you want a proper understanding of the Lindex.

Oh btw this is for IntLib, Redhat has looked into buying OpenSim, no decision has been made.

Darien Caldwell

Jun 22nd, 2010

Yep, LL has to refrain from buying $L, or it would lend legitimacy to it as a currency. Making your own money is illegal in the USA. LL has to keep it a license, and the only way to do that is by ensuring the Lindex is limited to transactions between residents, as far as buying goes. LL can sell, but not buy.

That’s also why they won’t take tier or Premium payments in $L either.

darkfoxx

Jun 22nd, 2010

So the same guy that only recently found out LL can (and will) terminate your account and owe you nothing of your inventory and L$, Which has been the case since at least 2005, is now a financial expert?

ROTFL!

Jeremiah

Jun 22nd, 2010

@Frans, If what you are saying is correct and LL is not allowed to buy L$’s on the lindex, then how did they keep the L$ stable through all those bailouts during the casino ban.

I’m also very curious who is regularly putting these 5 million L$ buy orders on the market in what seems an attempt to keep the L$ from sliding away, I’ve seen multiple of these orders come by the last hours, any ideas anyone?

Open Buy Orders at the Best 20 Rates

Exchange Rate Total Remaining Quantity

L$280 / US$1.00 L$888,166

L$281 / US$1.00 L$5,000,000

Jeremiah

Jun 22nd, 2010

ohh another 5 million was just added and btw those 2.1 million at L$295 was put there around the time the L$ started sliding away again a few hours ago.

Any commerical dealer would have let it the l$ slip even further away so they would be able to get a really good deal buying in L$’s

Is this really the doing of: “Financial Wizard to Prop Up Linden Dollar” or is IntLibber right and is LL buying lindens to save the economy from sinking away and making every investor leave in panic of a total devaluation?

Open Buy Orders at the Best 20 Rates

Exchange Rate Total Remaining Quantity

L$280 / US$1.00 L$768,166

L$281 / US$1.00 L$10,000,000

L$283 / US$1.00 L$620,911

L$289 / US$1.00 L$14,363

L$291 / US$1.00 L$209,012

L$294 / US$1.00 L$14,611

L$295 / US$1.00 L$2,130,012

It's Unfixable

Jun 22nd, 2010

He thinks the virtual world is real and that real world property laws apply to the fiction of property in multiplayer online services. All of the supposed law suits he’s been saying he’s filing (but has never actually filed) have been based on this one idea,

Unfortunately, he’s dead wrong. Here’s what happened to somebody who tried to sue Sony on that basis: http://www.techdirt.com/articles/20091008/0157466458.shtml

It's Unfixable

Jun 22nd, 2010

Freedom of speech does not apply in online services. The end.

It's Unfixable

Jun 22nd, 2010

On the other hand, if this chart is right, at the current rate of improvement on the value of the Linden, it should return to around $260L to the dollar in about two weeks, maybe a bit less. If you bought on the spike, prepare to cash in.

Hair

Jun 22nd, 2010

@Jeremiah

“Any commerical dealer would have let it the l$ slip even further away so they would be able to get a really good deal buying in L$’s”

Not necessarily. I’m a currency trader on Lindex and for me volume is more important then a wide spread. So I will deliberately tighten the spread to ensure that I can cycle the L$ through as quickly as possible.

So for example buying at 278 and selling at 268, will yield a small profit, but if you can cycle that several times it starts to build up.

The 5 million L$ orders are doing something similar, since we’ve leapfrogging each other on prices since this morning.

Persephone Bolero

Jun 22nd, 2010

@Darrian “Making your own money is illegal in the USA.”

Wrong. From the Wikipedia entry on private currency: In the United States, the Free Banking Era lasted between 1837 and 1866, when almost anyone could issue paper money. While there are more restrictions today than in this era, it is still legal to create your own currencies.

In short, it is absolutely legal to create your own currency.

Rinaldo Debevec

Jun 22nd, 2010

If it really is true that “Supply Linden” or some other agent of Linden Lab does not ever buy L$ on Lindex, and only sells L$ … that means that the recent recovery in the L$ value was entirely supported by SL customer demand and speculators. On the one hand, that should be seen as a tremendous vote of confidence in the future of SL. But on the other hand, it may mean that L$ is in for a very rocky road ahead, because markets can be fickle and might sell off again dramatically, and who knows where that might lead?

I don’t know whether I should be happy or worried!

But I will do some reading now to learn more about the issue, because I really don’t know about the rules governing Linden Lab activity with L$. Maybe I should just ask M Linden !

Frans Charming

Jun 22nd, 2010

Thank you Hair, for explaining how a Currency Trader works. I used be a currency trader, back in 2006.

It is all about speed and volume, you can’t let it the price slide because a other currency trader is more then happy to buy and sell on the smallest margin, and put up a new buyer before it ever slides down to your buy order.

As for the Casino bailout. I wasn’t watching the market back then, but either there where enough buy orders to absorb the people bailing out and/or the cash out was not as great as the AlphaVille Herald would like you to believe.

I expect most casino operators had as little L$ on hand as possible, once they needed to quit, their volume wasn’t that big.

IntLibber Brautigan

Jun 22nd, 2010

Rinaldo,

You are quite right. Folks need to ask the question: What do you believe more, that a Linden would tell the truth about whether LL buys back L$, or that there are some extremely rich, generous, and stupid SL residents willing to blow hundreds of thousands of USD in losses to stabilize the L$.

Note to the idiots trying to second guess me: You cannot SELL L$ at 278 and buy it back at 268 and make money. You lose 3.5%+ each time you try that.

Thus for whoever keeps posting 5 million L$ buy limit orders, they are basically paying Linden Lab $600+ US each time they sell back the L$5 million you bought. Furthermore, if some one other than LL is doing this, all they are doing is turning all the market L$ sell orders into limit L$ sell orders. They are changing the actual supply and demand for L$ zero. If you think someone can “corner” the L$ market this way other than Linden Lab, then I should point you to the story of the Bass brothers and their failed attempt to corner the silver market (an event during which Warren Buffett got rich off of the Bass brothers stupidity).

NOTE: While yesterdays prices were stable since the day before, market volume was 10 million L$ higher. At that time, sellers outnumbered buyers by more than 14 to 1, an extremely imbalanced situation.

Current sellers outnumber buyers by 6.3 to 1, a bit less unstable than yesterday. It seems like quite a few people are gambling they can now buy L$ from those who sell at market in a panic and are turning around with sell limit orders outside the 10 L$ spread, betting on the price improving over time.

PROTIP: While one could theoretically pile up some profits in the long term accepting a 10 L$ spread on ones buys and sells, your profit on each trade is less than a tenth of a percent. Thats a very thin margin and significantly less than the return on risk.

Persephone is generally correct, operating your own money system or means of exchange is legal in the US. The wording of the legal tender laws state that official US currency must be ACCEPTED for all debts, public and private, which means that, for instance, LL cannot refuse an offer to pay a bill with them with US federal reserve notes, but it does not preclude them from accepting other means of exchange. There are several areas of the US where there are alternative means of exchange operating perfectly legally, and furthermore, if what Darien said were true, then Disney could not accept Disney Bucks as payment for things.

The legal tender laws generally apply to government agencies, where, for instance, the IRS cannot refuse to accept Federal Reserve Notes (aka FRNs) i.e. cash in payment of income taxes, i.e. public debts, you the taxpayer are not obligated to pay it in FRNs but the IRS can refuse any other denomination but cash money. The fact that they do accept your personal check in lieu of cash indicates they do accept other means of payment.

Thus, legally, LL is NOT prohibited from accepting L$ as payment for its services or products. The fact is that they charge you a 3.5% fee to sell L$ in the first place, and they charge you L$ fees for uploading data to their servers (images, animations, sounds, etc) also demonstrates that they are accepting L$ in payment for services rendered. LL does accept payment for land it sells in L$, also. Another acceptance of L$ for services rendered.

The argument that LL magically controls how much people use all these inworld sinks is patently bogus, for it implies a degree of mind control over how much people upload images, animations, and sounds, and how much mainland land people buy.

Finally, the argument that I am somehow incompetent at financial matters because all my inworld assets were seized by Linden Lab after they engaged in a campaign of defamation of me and my business, stole my money, leaked my valuable proprietary business information to competitors, locked up my accounts and finally stole and deleted my sims is completely laughable.

I amassed, from a mere 200 dollars, a business worth a quarter milion USD in less than 6 months. I was on the verge of turning that into multi-millions when corrupt Lindens started interfering illegally in my business. They finally took it all, illegally, 9 months ago. I am now suing them for a half million dollars.

It is no different than any individual in history who has been too smart, too successful, and too outspoken against the corrupt and evil acts of government or other instrumentalities of power and control. The individual, dissident, maverick, is claimed to be incompetent, a criminal, etc when in fact the real evil is perpetrated by those who are able to rewrite history at the barrel of a gun, i.e. the state. In my situation, the state here is Linden Lab. This has happened to Jaques de Molay, Guy Fawkes, Mary Queen of Scots, Aaron Burr, and many others in history.

LL and its fanbois, kool-aid sippers, apologists, and sock puppets can continue to defame me and make up lies about me. The more I speak truth to power the louder then keep screaming the lies and hate.

The fact is that the Lindens ARE in fact now actively trying to stabilize the LindeX market. Nobody else would risk over US$100,000 at a time with a virtual guarantee of accomplishing nothing but losing more money to the risk being taken than is earned in profit. Only Linden Lab can truly trade at a 3.5% spread and make a profit. Anybody who claims otherwise is simply a liar and a Lab sock puppet.

Rinaldo’s statement that the assertion that the recovery of prices on the LindeX depends on public confidence in LL and the L$ economy is correct. The problem is that such confidence does not exist. After ditching 1/3 of its staff, banning any economic activity that is shown to be profitable for anybody not Linden Lab, banning any voice of dissent, and widespread seizures of private property by the Lab (I am not the only person suing the Lab, theres over $5 million worth of property owners in the current class action, my claim is only 10% of that), public confidence in Linden Lab and the L$ economy is at an all time low. There are not enough buyers to soak up the supply of those selling L$. Nobody in SL today has 10-20 million L$ sitting around they can risk, there are a handful of people in SL who have that kind of money on hand at any given time, and they are typically selling that to pay tier on their sims, which only increases the sellers.

IntLibber Brautigan

Jun 22nd, 2010

Frans,

During the Casino ban, most Casino owners kept their savings in Ginko Financial, which was promising something like 0.15% per day interest, an unrealistically high amount, and Nicolas Portocarrero refused to consider my warnings of the signs indicating that a ban on gambling would hurt his business. There were Ginko ATMs in most casinos at the time, and within hours of the ban, the casino owners had drained their Ginko accounts and were selling their L$ on the Lindex and other markets. This rush drained Ginko’s reserves and led to that banks collapse.

They had, prior to the ban, 5% reserves, Nicolas had told me at the time. 5% of 200 million L$, or 10 million L$. That was drained within hours, and Nicolas was rather busy over the next several days trying to bring money inworld as fast as possible. He first maxed out his own Lindex trading limit, then asked other folks with large trading limits to bring money inworld for him, including myself. He paypalled me I think $5000 USD twice to bring inworld, which I brought inworld and deposited in Ginko. Withdrawal demands in the queue maxed out at L$ 50 million, far more than he had cash on hand in RL to cover, and he was forced to convert his remaining depositors to bond holders, including myself (I had about a quarter million L$ in Ginko and L$675,000 in earlier Ginko bonds traded on the WSE, in the end I think I recovered about L$90,000, fortunately I had by that time moved most of my assets out of WSE so I was not hurt as badly as most people were, I knew of one fellow who was probably Ginko’s biggest depositor, he had 200,000 USD in L$ in Ginko from his sim dev work and lost it all cause he wasn’t paying attention to things.)

It was LL’s ban of gambling that is directly responsible for the collapse of Ginko Financial. Those who lost their savings in Ginko have only Linden Lab to blame for their losses. The ban of gambling in SL had the sort of effect on the SL economy that you would only see in real life if, for instance, the federal government banned automobiles.

That I was one of the few people who was not in any responsible position with Ginko but was aware of what was going on, due only to my friendship with Nicolas Portocarrero, and was unafraid to point the finger where ultimate responsibility lay: at the feet of Linden Lab, is one of the reasons the Lindens marked me for death. If the Ginko depositors ever chose to sue Linden Lab for their losses, I would have no problem testifying in court about what happened. As I have previously said, Linden Lab is an organized criminal racketeering organization.

This is much akin to the real world today, where people like Obama and Pelosi, Barney Frank and Harry Reid keep pointing the finger of blame for our economic condition on the banks and financial markets, when the fact is that it was the Community Reinvestment Act, passed by the Democrats, which forced banks to lend unsustainable loans to people based on a criteria of racial quotas and affirmative action in lending, ignoring whether the borrowers had any ability to repay their mortgages, that created the poisoned mortgage securities that caused the financial crisis. The politicians now claim the mortgage securities market was unsustainable and they were not at fault, which is a lie. Those assessing risk on those securities did so based on historical financial data that did not involve a history of lending to people based on social justice and not on their ability to pay. It was only inevitable that their risk assessments would so badly fail those who invested in them when it was the government that rigged everything with the intent to promote social justice in home ownership.

Metanomics show host Beyers Sellers once compared the Ginko meltdown to the subprime crisis, and he was exactly right. Ginko collapsed due to the de facto government action of Linden Lab in distorting the market by force majeur proscription against previously allowed economic activity and zero effort made to prepare the business community for the potential fallout.

Linden Lab and its apologists can continue to try to lie about the true historical record, but the internet does not allow Goebbels Law to succeed, the truth will always get out.

It's Unfixable

Jun 22nd, 2010

More TLDR; from Int. Ginko collapsed because it was a Ponsey scheme, much like IntLibber’s own ACE.

Qie

Jun 22nd, 2010

Try Hunt Brothers.

IntLibber Brautigan

Jun 22nd, 2010

Once again, Unfixable rams his head firmly up his ass. ACE always had a 100% reserve policy, and zero interest on deposits. So it was about the most un-Ponzi operation on the grid. We set this policy up three months before LL banned interest, they basically adopted our policy as their own. That we proved thereafter that we could operate our business without interest being offered was another mud in the eye of Linden Lab and all the morons like Unfixable here.

IntLibber Brautigan

Jun 22nd, 2010

Qie,

While the Hunt brothers had also made an attempt to corner the silver market, the Bass brothers also made a similar failed attempt. Lurk moar.

It's Unfixable

Jun 22nd, 2010

I would like to take this opportunity to remind everyone that ACE, BNT Estates and every other business thing IntLibber was doing in SL is completely out of business, with all the investors’ money up in smoke.

I’m pretty sure I don’t have my head up my ass on that part.

Cue Judge Joker, IntLibber’s alt, to come whine at all the furries for being mean to IntLibber.

IntLibber Brautigan

Jun 22nd, 2010

Actually, he’s not my alt, and my business was STOLEN by Linden Lab. We were operating just fine until the Lindens, and their JLU lackey’s, started actively driving my customers out of my sims, but ACE was in perfectly fine shape on the day LL stole it all. Customers had tons of L$ on deposit and it was all sitting in ACE BnT’s ATM system.

So, once again, Unfixable has his head rammed square up his ass.

Rinaldo Debevec

Jun 22nd, 2010

OKAY, no joking, here is what I found when I actually did some research about how Linden Lab manages the currency: I should not have shot my mouth off earlier in this blog and said foolishly that I “state categorically that Linden Labs has been buying up L$”.

I was WRONG.

It is TRUE that LL does NOT buy L$. The L$ finances of the SL world are designed such that there is always a very large need for users to buy L$. The Lab maintains currency stability by varying the amount of L$ they sell every day. When they need to support the L$ they just buy less than their usual amount. When the L$ is becoming over-valued, they sell more than their usual amount. Probably “Supply Linden” has cut back his/her/it’s (?) selling recently, to support the currency.

I actually have heard about this before, but I forgot all about it, probably because the L$ has been so stable there was no need for me to think about how the L$ rate is managed. The recent panic just shows that some aspects of SL are incredibly brilliant, and Linden Lab has a very ingenious design for the L$ economy. How do they ensure that users are always buying a lot more L$ than they are selling? I can’t explain that fully, but it is a result of things like texture upload fees, land auctions, fee to create a group, classifed ad fees, fees to list your parcel in search, and other L$ costs of using the service that result in a big net demand for L$.

IntLibber Brautigan

Jun 22nd, 2010

Another thing I’ve noticed on market activity, up until about 45 days ago, daily market volume rarely went lower than 80 million L$. Then we started seeing daily volume drop down to 70 million or so on many days, with a slight increase in volatility. There also used to be a rather large spike in trading around the first of the month, but this past month it was a good $15 million lower than usual.

I believe that Supply Linden reduced his daily L$ buybacks by 10 million a day a month and a half ago, but nobody noticed until a major estate owner shifted their tier payment patterns from the first of the month to mid month. If this is so, then the savings to LL has been enormous.

For those LL sock puppets who try to claim the SL economy did not shrink after the gambling ban, here is LL’s own data:

http://www.beatenetworks.com/blog/uploads/08_Q2_User2UserTxn.jpg

User to User transactions dropped in two months from $36 million USD equiv to 18 million USD equiv (one month for gambling ban to directly effect, then another month for Ginko to collapse as a result).

At the same time, the L$ value of land dropped from an average of L$8.5/sqm down to L$6/sqm, a two month contraction in the value of the land market of -41.67%, which is an annualized rate of -250% shrinkage.

Now, the Positive Monthly Linden Flow is a better read of what real economic growth is, because user to user transactions doesn’t tell you a lot unless someone is making a profit (U2U txns is essentially “stirring the pot”). LL doesn’t really publish much of this and makes it hard to find, but here’s the herald’s last attempt to track it long term:

http://alphavilleherald.com/images/old/6a00d8341bf70253ef0120a83b2386970b-800wi.jpg

As you can see, PMLF tanked hard after the gambling ban, from 80% growth down to a paltry few percent, even venturing into negative growth last year.

IntLibber Brautigan

Jun 22nd, 2010

Rinaldo,

Sorry, but this really doesn’t wash. Firstly, if LL can predict how much L$ people are going to buy before they do, they are in the wrong business, they should be teaching Wall Street a thing or two about predicting stock prices.

Secondly, the excuse that they can control the rates simply by varying their selling patterns is completely bogus. It goes against EVERYthing thats ever been written about currency exchange economics. Again, if LL is telling you the truth about this, then they need to be publishing a paper about this so they can win the Nobel Prize in economics. Truly, ground breaking stuff if true.

But, much like a UFO kook claiming to have discovered anti-gravity with their own unique theory of physics that contradicts general relativity and quantum mechanics, the burden of proof is on LL to prove their claims. I’m not buying it. Extraordinary claims require extraordinary evidence.

You cannot control the limit buy price of a commodity or currency market by changing only your selling behavior. Simply cannot be done. You’re ability to influence the market ENDS the moment you stop selling anything. If the rest of the market is willing to continue to sell and sell, even with high price elasticity, then you cannot influence this selling behavior unless you shut down the market completely. This is your only means of control once the market owner or market making trader stops selling if they are only selling.

For this reason, whoever told you this lie, Rinaldo, is absolutely full of crap. Even if Supply Linden himself isn’t buying L$ back, there has to be another deep pocket market maker who is willing to take losses to stabilize the market.

If there is such a person, and they are not owned or in a deal with LL over repatriation, then it becomes in LL’s interest to fleece this person by continuing to sell into the market. If LL is not pursuing such a strategy then it is not being duly diligent. So it becomes unlikely that there is anybody not in Linden Lab who is willing to take losses in order to stabilize the L$ market, therefore the claim that LL is not buying L$ back is statistically impossible, and given LL’s track record at telling the truth, it is clear that whoever told you this, Rinaldo, is lying.

Frans Charming

Jun 23rd, 2010

Thanks IntLib, your explanation of the gambling and Ginko metldown, confirms what I said in a round about way.

There where no large amounts of L$ on hand by the casino owners, to cash out. Ginko had to first buy it before it could be sold again, and could only do this over a longer period of time.

This answers Jeremiah’s question as to why the L$ remained stable during that time.

IntLib Said: “Note to the idiots trying to second guess me: You cannot SELL L$ at 278 and buy it back at 268 and make money. You lose 3.5%+ each time you try that.”

You are right, you generally try to buy more L$ and sell less L$ for your dollar. Your example would also not stabilize the Lindex, actions like that was what destabilized the Lindex, in a hurry to cash out.

Maybe you meant buy for 278 and sell for 268 ? That is what currency traders do.

Hair

Jun 23rd, 2010

Well you can certainly make a profit on a 10L$ spread. Once you factor in the 30 cents buying fee and the 3.5% selling fee. Then at current rates you need more then about 92,000L$ (will need to check the spreadsheet) to do it.

I’m certainly one of the traders that has a higher risk threshold, so am prepared to work on a 10L$ spread. Plus I’m also prepared to stabilise the price ranges, because for me stability will encourage liquidity, which increase the volume and speed of my trades that I can cycle through.

If anything, its been a good few days, have been trading about 1 or 2 million L$ a day at the moment, with a pretty decent return on the trades.

Qie

Jun 23rd, 2010

Check your sources. And spout less.

IntLibber Brautigan

Jun 23rd, 2010

Frans,

Yes, that is what currency traders do, but you cannot stabilize the currency in that manner. The issue at hand is that in a market panic, you have a large volume of people selling L$ at market, not limit, prices, overwhelming the number of standing limit buy orders, and causing the buy end of the spread to spike above 300. Now, while it is possible for people to do this with limit sell orders, selling at limited prices into existing limit buy orders, this only happens with a spread of 0.

Therefore, it is physically impossible for Supply Linden to control the market selling activity of users with nothing but its own sell orders. Supply Linden can control the ultimate volume of sell orders by restraining himself from selling as well, but that sort of governor has very limited utility and is only of use in a market with a net positive flow of capital into the economy of the currency being traded.

As soon as Supply Linden stops selling, it has zero control over prices and market sentiment will drive volatility. Since we have not seen any significant price volatility in four years, and it is a demonstrable historical fact that the SL economy has been shrinking for quite a while, both in the current era of SL as well as after the gambling ban, when as I posted earlier, there was a visible drop in user to user transactions of 50%, a drop in major market asset value of 30%, PMLF growth drop of 98%, both periods should have exhibited very significant drops in user confidence in the SL economy triggering a reversal in capital flows.

So no, the claim some are making that LL claims it only sells L$ is unsupportable from purely a market volatility analysis. It is statistically impossible to keep prices as stable as they have been merely by varying ones selling behavior. Such claims are bogus on their face, otherwise this sort of strategy would be used by governments around the world to keep their own currencies completely stable. Since they do not and cannot do so, then this claim fails and is a lie.

While it is true that Portocarrero did, for about a week, bring significant amounts of L$ into the economy at the beginning of Ginko’s collapse, it was still a minor percent of his overall deposit liabilities, and the subsequent implosion caused far wider damage and loss of public confidence. Ginko’s implosion caused users to pull funds out of the rest of the banking industry, with a run on most banks in the order of 30-40% of reserves. Many banks, like Frank Corsi’s “The Bank”, did not survive these ripple effects and caused additional panics and loss of public confidence in the SL economy.

Many people who had invested large amounts in the SL capital markets proceeded to liquidate their holdings and exit SL with their funds.

IntLibber Brautigan

Jun 23rd, 2010

Now, those claiming the market is calming down are being disproven as of yesterdays market data, with an uptick in the average price by 1L$ and a daily high reaching up to 295 L$ to the dollar.

So Frans, did Supply Linden do that intentionally, or am I right and Supply Linden has zero ability to control buy prices merely by varying his selling?

Rinaldo Debevec

Jun 23rd, 2010

Illusions of reality! (or should I say “delusions” of reality ? )

Mr Brautigan: please remember that SL is not a real world, SL and the Lindex are an alternate virtual world, the basic laws that govern SL are the invention of Philip Linden and others. SL is a remarkable model of the real world, but it isn’t exactly the same as the real world.

IntLibber Brautigan

Jun 23rd, 2010

Rinaldo,

The laws of economics are the same everywhere, just as 2+2=4 in every possible universe. Only in the everyday fantasies of Prok’s useful idiots is this not true.

Economists actually study the SL economy, and those of other virtual worlds like EVE Online and World of Warcraft, in their academic work.

While certain 19th century fantasists like Marx, Engels and Lenin tried to claim there were other models of economics that worked better, they were proven quite wrong and lie in the dustbin of history. What is sad is that there are some folks who still cling to their delusions as if they are fact.

It's Unfixable

Jun 23rd, 2010

<_< Remember that Intblubber destroyed his own estate by mismanagement, and was banned from SL for an accumulated history of fraud. What he knows about economics he used to steal other people's money and run for the hills with it.

It's Unfixable

Jun 23rd, 2010

The market spike is nearly played out, and the minimum bid rate is back down around $260L to the dollar. Not only did it work out exactly the way I said it would, it happened a lot faster. Time to cash in! (I’m rich.)

IntLibber Brautigan

Jun 23rd, 2010

Once again, Unfixable’s head is rammed square up his ass. LindeX hasn’t gone near 260 in a week. The minimum rate for the the past three days has been 265. Once again, Unfixable’s lies are exposed.