ESC to IRS: We Want Beef!!!

by Alphaville Herald on 02/06/08 at 12:12 am

Giff Constable and Michael Morton refuse to repay workers for taxes the IRS says the Sheep should pay

by Pixeleen Mistral, National Affairs desk

After acknowledging an IRS ruling stating Second Life in-world greeters the Electric Sheep Company employed to help visitors to the CSI:NY metaverse/television cross promotional event are ESC employees rather than contractors, the ESC is now changing it’s tune.

Rather than compensating employees for the employer tax/social security contributions the ESC should have made assuming that the workers are actual employees, the company is now taking a defiant line – and says that the IRS ruling is wrong.

While this approach will certainly result in more publicity for the Electric Sheep Company, some observers wonder at the potential costs – wouldn’t it be simpler to just pay the back taxes and move on to developing the metaverse? Or are the ESC accountants and lawyers simply enjoying a bit of roleplay after already having written off the tax costs for misclassified employees? Perhaps it is cheaper to pay the lawyers and accountants than the employees?

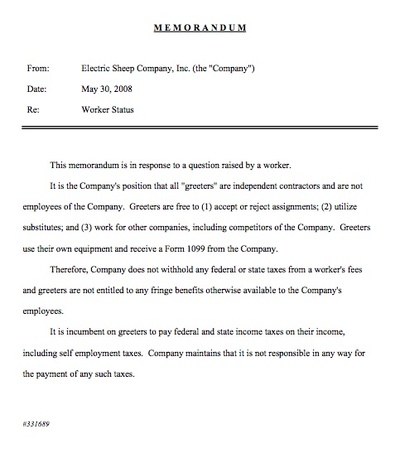

Michael Morton’s memo to employees workers of disputed status

Based on an e-mail sent to ESC greeters by Michael Morton, and Giff Constable’s blog, the company believes that because part time greeters can say when they cannot work, suggest substitutes to cover for their regularly scheduled work hours, and work for other companies – they must be contractors. For anyone who has worked a part time hourly job this may not ring true, but perhaps the ESC has better tax attorneys than Starbucks – where part time employees can work for other companies, get substitutes to cover for them, etc.

The ESC leadership has gained a reputation for sharp business dealings in the aftermath of laying off 1/3 of their full-time workforce the week before Christmas. Suggestions that this could have had something to do with avoiding stock vesting for some employees still linger.

Still, we have to wonder at the wisdom of wanting a beef with the IRS – aren’t Mr. Constable and Morton getting enough meat in their diet? Or do they need a loan extension from their $8/hour greeter employees to cover the back taxes?

Anonymous

Jun 2nd, 2008

I heard the IRS caseworker snorted when she heard about the petulant attitude of the ESC regarding the parental smackdown.

I’d take away their computer. Bad Sheep! Bad!

Are they completely dumb or just hard up for cash? They could just pay the backtaxes and make this all go away.

anon

Jun 2nd, 2008

Maybe the Electric Sheep Company is coming onto hard times trying to trade Pixel Dust for real money…

Get Over It

Jun 2nd, 2008

They are/were contractors because they were hired for a project. Let it sink in…

You have no story.

lolwut

Jun 2nd, 2008

in b4 IRS takes their computer away

EnCore Mayne

Jun 2nd, 2008

as simple as your sensational game of get hits to the site is, the complexity of the various options and intricacies of business taxes is not on the same level. if Tenshi (a paid ESC “contract greeter”) wants her grievance heard she’ll have to wait for the sheep’s file to be interpreted by your country’s irs. from someone who knows the Cdn tax situation intimately she’s fighting windmills and/or ghosts since the contracted payment method is more beneficial to her. duh.

FlipperPA Peregrine

Jun 2nd, 2008

The IRS got this completely wrong. ESC should make it right, for all of us. Or does the Herald want to start paying their writers full wages?

Anonymous

Jun 2nd, 2008

Encore, I doubt you know what you’re talking about. Your crazy ass has been puking all over the internet acting like you know how real life works. You should go back there for a while. I hear they miss you.

If Tenshi had a “grievance”, isn’t it already solved by the fact that she filed and the IRS deemed her correct that she was NOT a contractor, but an employee? Where did you miss the fact that the IRS SAID she was an employee via proper inquiry filing?

When you file an SS-8, both the employer and an employee have a chance to be heard before it’s passed on to a caseworker for review. So much for your knowledge of business taxes.

anon

Jun 2nd, 2008

The sheep are fucked.

It’s obvious in the memo that they’re going to “white lie” their asses off in order to swing the IRS in their direction. The memo doesn’t state all of the various implications of the job, only the ones that would make the Odd Jobbers “contract workers”

great job, sheep.

anon

Jun 2nd, 2008

i’ve worked a few part time jobs in my time and they let me say when i had to take time off, suggest substitutes, and work for other companies as well. that doesn’t mean that it’s contracted. no, i got a w2 just like the full time workers.

dumbasses.

Maria

Jun 2nd, 2008

Good for them!!!

The employment situation at Starbucks is easily distinguishable: the greeters were in their own homes (or location of their choice) using their own equipment. Also, as anon correctly pointed out, they were hired for a project.

Anonymous

Jun 2nd, 2008

I find it hard to swallow that the IRS made a wrong judgment when both sides had ample time to present their case.

Prokofy Neva

Jun 2nd, 2008

The ESC is right about this. These are clear-cut 1099 employers. I’ve been up and down on this issue 100 times myself with lawyers and organizations, both hiring 1099 employees and being one. They fit every definition of a 1099, and their lawyer is absolutely right to challenge this, and it’s a good thing for all of us that they are.

What’s amazing is that any 1099 worker in this situation would be demanding that ESC do otherwise, purely from the perspective of their own interests. As a 1099, they do not have taxes taken out of their paychecks, as they are paid as contractors. They themselves have to pay their own taxes, but they pay those taxes after they have written off their expenses. So their home office, computer, DSL line expenses can in part be written off. They should likely come out ahead that way.

Cocoanut Koala

Jun 2nd, 2008

Exactly. They are 1099 employees.

coco

Jim Jones

Jun 2nd, 2008

If they were clear cut 1099 employees, then why would the IRS rule otherwise?

Prokofy Neva

Jun 2nd, 2008

>If they were clear cut 1099 employees, then why would the IRS rule otherwise?

Possibly because Tenshi, as a disgruntled former employee, wished to make trouble for them, and the IRS had to investigate it and perhaps did not get the full story?

sheepswool

Jun 2nd, 2008

I find it hard to swallow that both parties filed – re: stated their case ; and now the ESC is whining they were shafted? They had time, they had the ability to say what they needed to say.

If Mommy doesn’t give you what you want, go to Daddy, right? Either way they have to go back through the same caseworker, otherwise the IRS will be pissed that they’re wasting time. Where’s Giff? Normally he’d be here going off by now

FlipperPA Peregrine

Jun 2nd, 2008

Jim Jones: the IRS is comprised of humans (despite appearances to the other wise) – they often make mistakes. They’re also extremely busy at the time of year that just passed, and probably glanced at this question for all of 15 seconds.

Or are government run bureaucracies infallible? I’ve worked as a contractor (as both sole proprietor and owner / primary member of an LLC) many times in my life, and this is definitely contract work.

I’ve worked as a contractor (as both sole proprietor and owner / primary member of an LLC) many times in my life, and this is definitely contract work.

Employment Law Professor

Jun 2nd, 2008

@Prokofy: “the IRS had to investigate it and perhaps did not get the full story?”

Whereas the omniscient and infallible Prokofy somehow does have the full story (even though the complete facts in this case are not yet a matter of public record) and is therefore able to bless us all with his flawless pronouncement that the case is “clear-cut”.

No, the truth is that nobody commenting here — not Prokofy, not me, not anyone else — knows all the facts. And, as Prokofy’s lawyers have surely told him, this is a highly fact-dependent area of law. The fact that the IRS made an initial determination that these are employees is, as others have observed, not the final word. It might even be wrong. But, it is at least an indication that the facts are less than clear-cut. It is pitifully irresponsible for anyone to make sweeping assertions based on incomplete facts gleaned from blog posts, one-sided public statements and cover-your-ass memos. Any lawyer who did so would be subject to a malpractice claim. Anyone else who does so is simply foolish.

Marc Woebegone

Jun 3rd, 2008

Profky and KooKooCOCO, you’re as ridiculous as usual. There’s no such thing as a “clear cut” independent contractor. Picking your own hours is just one of the elements necessary… always pontificating but never educating you two.

http://secondlife.typepad.com

Marc Woebegone is back!

Senior Gates

Jun 3rd, 2008

Having been on both sides of the contractor dispute before, I can say the IRS will bug the hades out of you, in regards to presenting your case. We were given almost 4 months to assemble documents and submit, on a contractor dispute. There’s a ton of talk, back and forth, between company and IRS if the company is willing to do so. After the ruling though, it’s sorta “set in stone”. It takes big court to reverse a ruling from the IRS.

It’s almost like a court case, TBH. Looks like the employee went in with better information than what ESC did, and the IRS ruled accordingly. It’s too late now to go back on the matter, doubly so with that e-mail. That’s just opening doors to a lawsuit, and to follow the blunt letters of the law, (IRS made a ruling, ESC publicly states they will not follow ruling), illegal. Good luck ESC.

LAWlzers

Jun 3rd, 2008

Prokofy is agreeing with Flipper. Now we just need to throw Aimee and maybe Reuben into the mix and we will have the Four Horsemen of the SL Apocalypse.

Senior Gates

Jun 3rd, 2008

Also, since I started researching this…this come straight from the IRS website.

Under common-law rules, anyone who performs services for you is your employee if you can control what will be done and how it will be done. This is so even when you give the employee freedom of action. What matters is that you have the right to control the details of how the services are performed.

If ESC was controlling what will be done by the greeters and how it was done, even something as simple as a Greeter SOP, then it looks like the IRS made a correct judgement. From what I gathered, ESC made the geeters sign things like NDA’s, had a set number f hours they had to work a week (even if they got to choose when), and such. That seems pretty controlling. That line about “even when you give employee freedom of action” is the clincher. Everything else is just smoke and mirrors.

Wolf in Sheep's Skin

Jun 3rd, 2008

That’s exactly all the ESC has ever been. I wonder where all that $7mil contract with CBS went? You can’t tell me they spent it ALL on SL. Someone, somewhere, had a nice Tahiti vacation.

Cocoanut Koala

Jun 3rd, 2008

Marc Woebegone, we were better off when you were gone, so could you be gone? Again?

Then there would be less woe – for me, at least, because you wouldn’t be making up silly names to call me, so unlike the professional and successful attorney you apparently claim to be.

You’re mad because I didn’t approve of your buying LL land for lower than the base price of $1,000 by using an unintended back door to get in and make low bids. (And I believe I also said we were all better off without you.)

As for the 1099 business, it isn’t – as few things ever are – a black-and-white issue. However, in the case of these greeters, I think it is good evidence that these are not regular employees, and fall into the 1099 category.

I work on contracts that require assignments to be completed or the contract has not been met. I do this on my own time, by deadline, and not in the offices of the contractor. My employer most definitely controls what I do, but I am without doubt a 1099 employee.

I am very much a “clear-cut independent contractor, so yes, there is such a thing, and it is indeed a good thing to be, from the employee’s standpoint.

(And in this case, I think the individuals are pretty clearly independent contractors as well, though not as clearly as I am.)

My husband, on the other hand, used to teach summer art camp at an art center. For years, these three-month employees were treated as contract labor. The IRS made them start treating them as regular (if part-time) staff – albeit without any benefits whatsoever.

The art center didn’t like that, but it seemed to me the IRS ruling was correct in that instance.

So there are all shades and flavors of this, but I believe the ESC greeters are clearly 1099 employees, as opposed to the more iffy situations, such as the one I mentioned about the art center.

coco

Ranma Tardis

Jun 4th, 2008

Does not really matter, the IRS has made a ruling and they will win. They have the power of LAW behind them. They have the right to seize bank accounts, income, and property. Picture this one day their credit cards and debit cards will not work. They go to their legal residence to find it padlocked and a notice of federal seizure. Then they get introduced to the nice Treasury Agent arresting them for tax evasion.

It is an act of madman/women to oppose the Internal Revenue Service. Enjoy your time in Prison! They will enjoy you to the fullest! Hope you enjoy being a sub!!